Astonishingly, Sydney house prices are almost 40% higher than 3 years ago.

Towards the end of last year many commentators were projecting that the market would cool and that interest rates may go up - the opposite has happened.

The strength of the Sydney housing market was reignited when the Reserve Bank cut interest rates to 2.25 per cent in February. Auction clearance rates since then have been above 80 per cent each week. Sydney’s clearance rate hasn’t been this high for this long since 2008.

This month we case study the suburb of Beacon Hill. Take a look at this typical home in Beacon Hill that last sold in 2012 for $850,000.

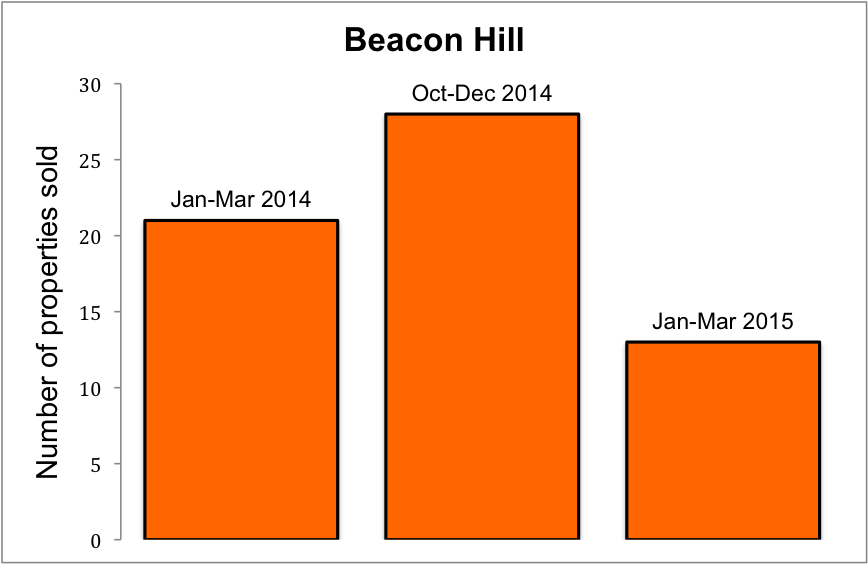

There are approximately 20% less properties on the market from this time last year. Take a look at this graph showing the volume of sales in Beacon Hill for the first 3 months of this year compared to the same time last year and the last quarter of 2014.

Last month we sold this unique townhouse in Brookvale that was last purchased by our vendors 12 months ago for $812,000.

Investor mortgage activity still comprises 60% of the total buying market. The investor share of market has never been more than the owner-occupiers share since records began in 1995.

This unusually high activity has forced APRA to place stricter rules on investor loans as the RBA battles with trying to stimulate the economy by lowering interest rates.

It does pose the question of how much longer the growth can persist?

And one word of warning - when the Sydney housing market starts to lose momentum, there is some risk that recent investors could be left holding a very expensive but low yielding asset with a lower than expected rate of capital gain over the coming years.

Thanks for reading,

Tony.