The auction clearance rate Sydney-wide last weekend was 18% lower than this time last year. This was the first ‘Super Saturday’ of the year, and it was the slowest start we’ve had in 5 years.

It’s not all doom and gloom on the Northern Beaches however, as we saw a respectable 72% clearance rate. It’s still a tale of two cities with areas like Sydney’s southwest felling the brunt of the slowing market, with a clearance rate of just 46.51 per cent. In Parramatta, it was 52.94 per cent.

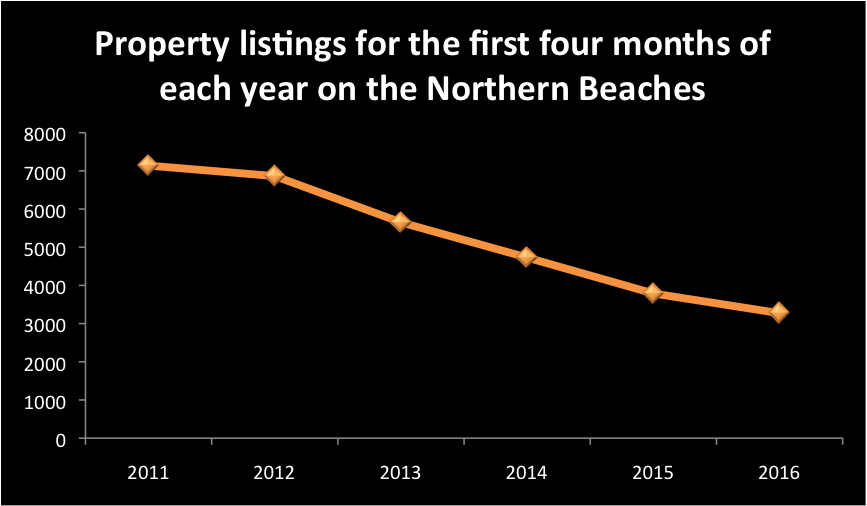

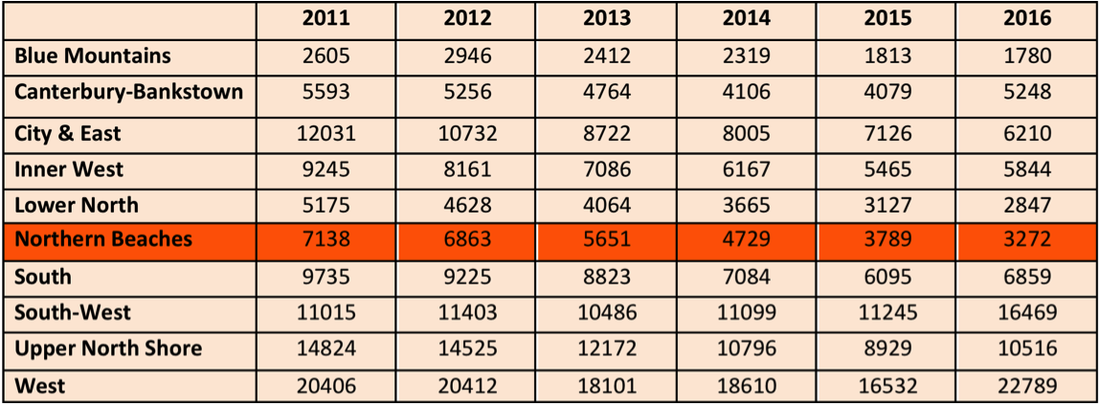

There are currently 16.4% more listings on the market in Sydney when compared to this time last year. This, combined with stricter bank lending on interest only loans would be the main drivers leading to zero capital growth in Sydney over the month of August.

However we are still 12.7% higher than this time last year and properties are taking a little longer to sell, but still inside a month.

Sydney's housing crisis however has reached an alarming new threshold with a key measure revealing it now takes more than two average full-time wages to affordably service a loan for a typical city home.

The Housing Industry Association's housing affordability index, which measures the capacity of households to service mortgages, shows Sydneysiders must fork out $4,729 per month, or nearly $57,000 a year, to service a standard mortgage on an averaged-priced home in the city.

That is more than 30 per cent of the earnings of a Sydney household with two average full-time wages – the portion of income widely accepted to be a manageable housing repayment.

While interest rates remain at historic lows, Sydney’s appetite for property remains.

But as more and more negative headlines come, buyers will try negotiating harder with their purchases and although it is likely that interest rates will remain on hold for at least another 12 months, watch out for when they eventually start to rise.

This is a time when the correct marketing and negotiating is crucial to obtaining a boom-time result.

Just like a great teacher will have a direct bearing on a child’s education, a great agent will have a direct bearing on the sale of a property and its result.

If you would like to have your property sold before Christmas, now is the time to begin the preparation phase. Feel free to contact me any time to schedule an initial meeting

Thanks for reading,

Tony.