First of all, dwelling values have changed by -2.4% in the three months ending in February.

Second, there were 9.4% fewer sales in February of this year compared to February of 2017, and this is from a much larger sample size too – there is 27.4% more property for sale at the moment in Sydney compared to March 2017.

Thirdly, this glut of property on the market and lack of transactions has caused the average selling time in Sydney to balloon out to 68 days. This is a stark contrast to the sub-30 day selling time we have witnessed over the preceding 4 years.

First home buyer demand is still climbing, however this is in part due to the mass exodus of investors in the market as they struggle to obtain finance.

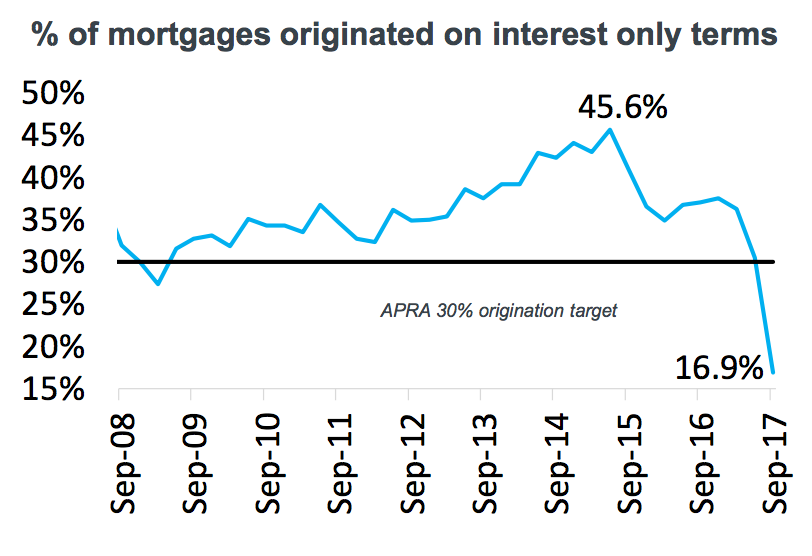

Check out this graph showing the dramatic drop of interest-only loans from Sept 2015 to Sept 2017:

In response to this, the big banks have just made significant cuts to their interest-only rates. This was after the RBA announced last week that the cash rate would be kept on hold.

On to more local news, auction numbers on the Northern Beaches have dropped significantly. On the last weekend of February, 67 auctions were scheduled for the Northern Beaches but only 34 went ahead.

This would be the statistical proof of the end of the buyer frenzy. Sellers who may not be too comfortable going to auction in the current market conditions are choosing to sell prior if a decent offer is made.

The most recent weekend was more of the same story, as 17 scheduled auctions were sold prior.

The good news is that as long as property is priced right it is still selling. On the Northern Beaches over the last 3 weekends 75%, 81% and 78% of the properties originally listed for auction eventually sold.

These are strong numbers and the market seems to have found a new level - still making it a good time to sell. Of course, the right preparation, presentation, method of sale and negotiation style all play a part in it.

To discuss more on how I have honed these skills over my 33-year career, please do not hesitate to contact me at anytime.

Thanks for reading,

Tony.