The city-wide median has decreased 4.5% since this time last year, with the top-end of the market recording the biggest falls.

According to Domain, house prices on the Northern Beaches have decreased 8.1% since July last year, and unit prices have decreased 5.7%.

The auction method has also decreased significantly, only 17 auctions were scheduled on the Northern Beaches for the first weekend in August, of which only 4 sold at auction, with 6 selling prior.

The good news for the Northern Beaches is that the demand to live here is still very strong. At the beginning of July, Freshwater and Forestville were two of the most-searched suburbs in Sydney, according to realestate.com.au.

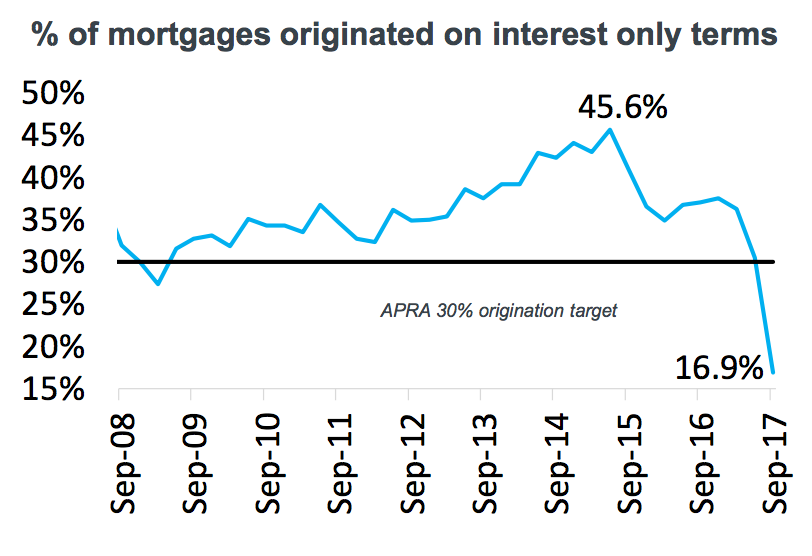

There’s been many reports in the media that the fall in prices is due in large part to monetary policy and a looming credit crunch. However, it must be noted that overall credit lending has only dropped 1.8% in total since the peak in lending in November 2017.

What’s alarming is that investor lending has dropped 27.5% since the peak. This is a result of the banks cracking down on investor lending, following orders issued by APRA and of course the ongoing royal commission into banking.

I feel that this is just the beginning however, and we will see credit availability drop further as time goes on.

The market is undoubtedly cooling, but it is not collapsing. Over my 33-year career I’ve seen all the booms and busts, and I want to make it clear that this is not what we are experiencing now.

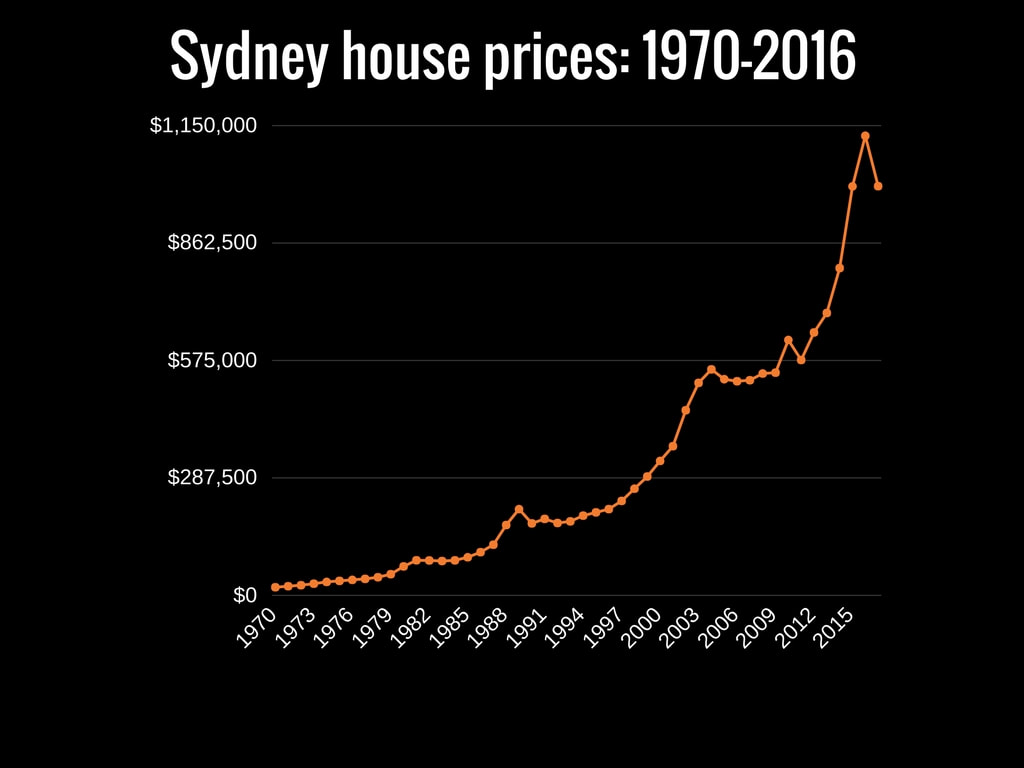

After phenomenal growth of around 75% in Sydney property values from June 2012 - June 2017, it’s only natural that we see some pull-back in the market. It’s common to see a slight decline following a boom.

We certainly aren’t seeing streets and streets of vacant properties on the Northern Beaches right now, nor will we ever.

Although there is a lot of negativity out there, this agent remains confident.

This week we sold a 67 year old knock down home in North Curl Curl for $1,956,666 and we sold this old house Off market in Brookvale for a record $1,600,000.

So I love it when people profit from my knowledge.

If you’d like an update on the value of your home in this changing market, please do not hesitate to contact me at any time.

Thanks for reading,

Tony.