Sydney’s meteoric rise has seen house prices increase by a whopping 28.2% since the beginning of this growth phase in June 2012.

This latest statistic validates what I always say to my clients: what looks expensive today is cheap tomorrow! If you bought a property a couple of years ago on the Northern Beaches you are sitting on a very healthy capital gain in such a short period of time.

Sydney’s auction clearance rates still remain at record highs; 83% of the 253 homes listed for auction in the first weekend of October were sold, even though it was a holiday weekend. This also marked 8 straight weeks of auction clearance rates above 80% in Sydney.

Properties are still selling fast at a little over a month on the market, which is slightly faster than this time in 2013.

But why has Sydney’s market been so strong in comparison to the rest of Australia?

What sets Sydney apart from the other states is its rate of population growth.

Sydney’s growth in population, apart from Melbourne, is on another level compared to the rest of the country. 25,000 new people were added to Sydney’s population over the March quarter alone. They need somewhere to live. This, along with low interest rates, is encouraging more and more investors to buy real estate. Nearly 60% of all borrowing activity in Sydney is coming from investors, who are capitalising on the longest consecutive period of no interest rises for almost 10 years and at their lowest levels in over 60 years.

However, the jury is out now as to whether the Sydney market is overvalued or even in a bubble that is about to burst.

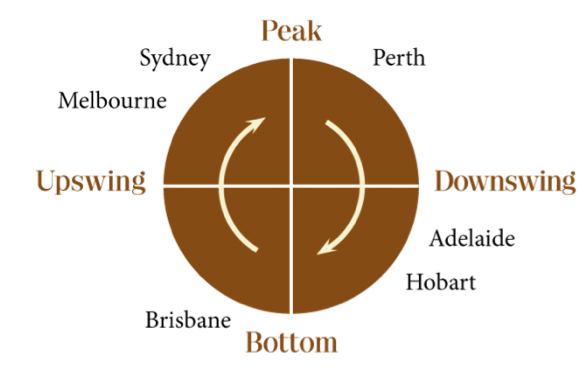

If you look at the property clock, Sydney is sitting at around 11 o’clock. It’s hitting its peak:

The Northern Beaches is starting to see rental yields fall under 4% because property values have risen so much higher than what rental values have.

The other huge dent to any real estate market are higher interest rates and although the RBA have not hinted at any interest rate rises soon, we can predict that sometime in the next 12months they may be forced to take action. Interest rates cannot stay at these record lows forever.

This will most likely be encouraged by employment rates – Keep an eye on the unemployment rate. When the number of jobs available starts to rise, this will be the catalyst for interest rates to rise.

If you would like any other real estate assistance or advice, please do not hesitate to contact me on 0418 479 738.

Thanks for reading,

Tony