This is the largest three-month decline since August 2008 at the height of the GFC. And this is also following a 1.3% drop in the final quarter of 2017.

And speaking of the GFC, a report has come out that homeowners in some pockets of Sydney have had to reduce their asking price by up to 30% in what is being described as ‘GFC-style’ price declines.

This report has named many areas of Sydney but as to be expected, none are located in the Northern Beaches.

But before you get too worried, it’s important to know what price these homeowners started from.

It is a common symptom of the homeowner who sells after the peak to expect a boom-time price for their home, and at the same time a symptom of the buyer to expect to pay much less after a boom.

Both parties are exaggerating the price change and both inevitably will meet in the middle after a generally longer selling campaign, hence why the average selling time in Sydney has blown out to 60+ days.

As you may already know, I’ve been a professional in this industry for 33 years and I’ve seen my fair share of market cycles, and this same thing happens every time.

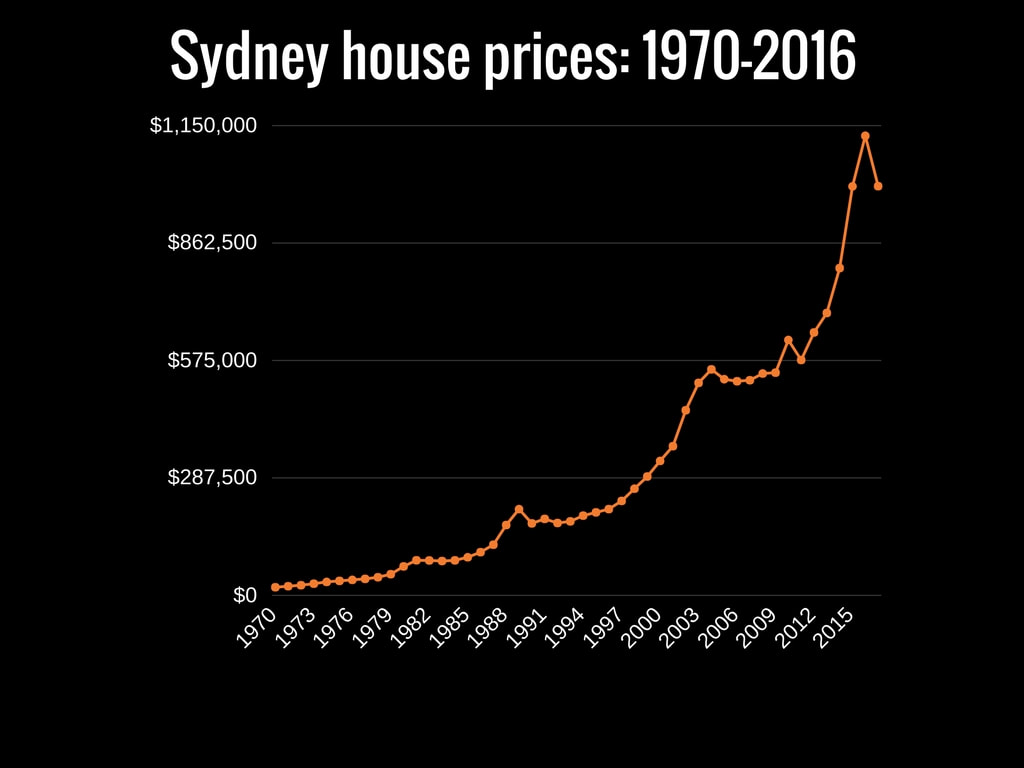

In 1987 to 1988 we had a boom where property values doubled in price, which followed a period of slow growth in the early 1990’s after ‘the recession we had to have’.

From 1996 prices started to rise again as interest rates began to drop. This lead to another phenomenal rise in property values, with a huge spike after the 2000 Olympic games through to 2003.

This again lead to a fall in prices with a period of flat growth to 2009, before a quick sharp rise in 2010, followed by a plunge in 2011, which was setting the scene for the meteoric growth we experienced from 2012-2017 as interest rates dropped significantly in this time frame.

The period that follows next is just following the historical trend in the Sydney real estate market, where we have seen a pullback in prices from its peak mid-2017, and if history is to repeat itself we will experience a period of flat to negative growth over the coming years.

Sure, auction clearance rates and property values have dropped however the bottom line is that this is to be expected from the meteoric rise we have experienced over the last 5 years.

For the realistic homeowner who understands the importance of preparation in a sale, and coupled with an experienced real estate agent, your selling campaign can still be very successful.

If you know of anybody who is thinking about making a move but is concerned about timing, I’d love to continue the conversation. Please pass on my contact details.

Thanks for reading,

Tony.